The crash course on credit cards I wish I had in college

Save thousands by playing the credit card game

This December, I’m flying to Japan and Taiwan for almost free. Meanwhile, banks are willing to offer me large loans on favorable terms—all because I considered credit card strategies in college.

Here’s a crash course to help you harness the same benefits without turning credit cards into an obsessive hobby like I did.

WHY YOU NEED A CREDIT CARD.

Some people claim credit cards are dangerous, but that advice is often misinformed. Credit cards are only risky if you misuse them. In fact, they’re essential for building your credit score—a metric lenders use to gauge your trustworthiness in repaying debt.

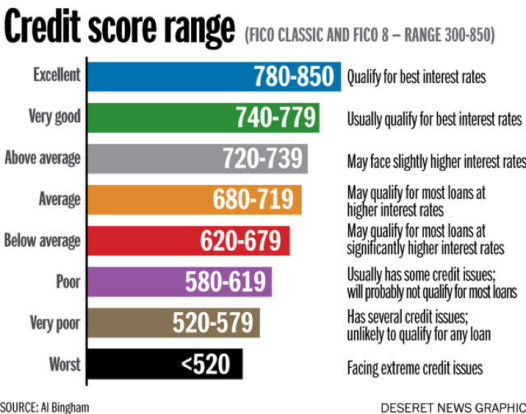

Without a strong credit score, you could face steep financial penalties, from higher loan interest rates to rental rejections.

Big purchases like a house require a loan. Without a good credit score, you’ll face higher interest rates or get denied a loan entirely.

For a 500k mortgage, a credit score of <620 instead of >750 can cause you to pay $180k more in interest payments in the long run assuming your interest rate on your loan is 1.5% higher with the lower credit score.

Renters aren’t off the hook either—tenants with strong credit scores can edge out other tenants applying for the same unit.

In just two years, you can have a score that serves all your credit needs by following these credit card rules:

Pay off your card before the payment due date every month.

Set it to autopay if you’re worried about forgetting.Spend between 5%-25% of your credit limit.

For example, if your credit limit is $1,000, try to spend $50–$250 monthly to optimize your score.

That’s it! Pay off your balance and avoid overspending, and in two years, you’ll have a stellar credit score. After three years of this practice, I got mine to 791/850.

My Mini But Mighty Credit Card Arsenal

1. Bank of America Cash Rewards Card

No annual fee

3% cash back on a chosen category (I pick dining when I have a girlfriend, gas when I don’t)

2% cash back on groceries

1% cash back on everything else

Last year, I spent about $8,000 with this card and got back $200. This was my first card, and it helped build my credit score while being easy to manage since Bank of America is my primary bank.

I recommend finding the free card associated with your bank that offers basic cash rewards if you want to optimize for simplicity. If you are more savvy than me and do not care about bank overlap, these are epic beginner cards:

Discover it Cash Back Card: No annual fee, 5% cash back on rotating categories, plus a first-year cash back match—this means if you earn $200 cash back, Discover doubles it to $400!

Chase Freedom Flex: No annual fee, 5% cash back on rotating categories, 3% on dining and drugstores, and a $200 bonus after spending $500 in the first three months.

2. American Express Platinum Card

Annual Fee: $695 (I flinched when I first saw this number)

Meaningful Benefits:

$200 airline credit

$15/month Uber credit, $20 in December

$20/month entertainment credit (Netflix, WSJ, etc.)

Lounge access at major airports (saves me ~$200/year on food while traveling and adds comfort)

Clear Access $200 credit (helps with international travel—skip the lines where those face scanners exist)

The main reason I got this card? The welcome bonus: 125,000 AmEx points, which is roughly $1,250 in travel credit when booked through their portal. You receive the welcome bonus by meeting some spending threshold like $6,000 in 4 months. If getting to a high number in spend like $6,000 seems challenging, ask to use your card for your friends’ or family’s large expenditures and get reimbursed by them.

Paying LA rent and buying food and christmas gifts got me to the spend threshold to earn my welcome bonus last year.

I used the welcome bonus points to book all of my upcoming Asia trip.

Year 1 Value:

Welcome bonus: $1,250.

Airline credit: $200.

Uber credit: $200.

Entertainment credit: ~$250.

Total value: ~$1,900 for $695.

If you use these basic benefits, the card’s first-year value is undeniable.

For Year 2, I planned to cancel, but AmEx offered me a retention bonus of $350 if I spent $4,000 in 3 months. By leveraging big expenses like rent and group dinners, I will hit the spending mark.

Factoring in benefits like the airline credit, Uber credit, and lounges, the annual fee will be worth it for me for another year.

Choosing the Right Card for You

If you’re just starting, pick a free card with your bank or the epic ones I mentioned earlier and start building credit. Go to the card’s associated website and fill out a simple application and you should get the card in no time.

Cards with annual fees can make sense if you understand your spending and want to maximize rewards. FYI, these cards often prefer you to have a credit card history so maybe don’t jump to these cards as your first card.

If you are a frequent traveler or intend to be soon (study abroad kids!), AmEx Platinum Card, Capital One Venture X Rewards, or Chase Sapphire Preferred may make a ton of sense with how the cards are crafted.

If you love fine dining, the AmEx Gold and Capital One Savor Cash Rewards cards offer high rewards—4x points on dining with AmEx Gold and 4% cash back with Capital One Savor—making them ideal for food enthusiasts.

Advanced Tips & Hacks for AmEx Cards

One issue with AmEx points is their limited value for non-travel expenditures (typically 1 point is worth less than 1 cent in non-travel expenditures).

However, I discovered a quirky workaround: if you book a flight with points and cancel within 24 hours, AmEx refunds you in cash rather than points.

I verified this with an AmEx agent, and they confirmed it’s standard protocol. That said, this may change in the future, so message AmEx before trying this sneaky tactic.

Professional Considerations

If you’re going into consulting or another professional service, your company might issue you a corporate card—often an AmEx. Using the same credit card system personally and professionally allows you to aggregate points and redeem them more effectively.

While I sometimes find AmEx overrated, its perks, combined with my professional use, make it practical for me to stay in their ecosystem.

Shoot this article to a friend you think is brilliant. Showing the power of credit cards to friends has been awesome as my friends ask great questions and become similarly interested in the credit card game. Now, I do not seem like an oddity when I debate which card to use at dinner. :)